There are a few programs and you will routes to getting into the real estate field. Having first-go out homeowners specifically, two types of lower down-payment proceed this link here now fund try FHA and you can Antique loans. The Lender at EPM helps you need a deeper research and decide and therefore mortgage suits you. But i would also like to take some prominent inquiries and you will put from pros and cons away from each other sort of mortgage loans, getting a start towards the wisdom exactly what the financing conditions was, and you will which kind of loan you are going to match your needs better.

What’s the Difference in FHA and you can Conventional Funds?

FHA signifies Federal Property Administration. And you can FHA money is supported by the us government. The brand new FHA guarantees these lenders and they are readily available as a result of FHA-acknowledged loan providers in the You. This might be a good place to start for basic-day homebuyers who don’t provides a massive deposit available or could have a lower credit rating.

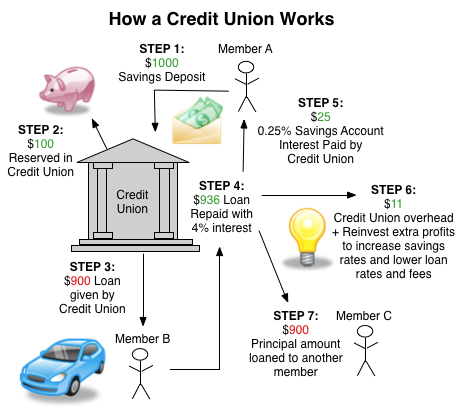

Conventional Home loans is actually got its start and you will serviced by the personal mortgage brokers, finance companies, and you can borrowing unions. Of numerous loan providers exactly who bring old-fashioned finance will additionally bring regulators-covered fund. When you yourself have a stronger credit history otherwise provides spared a good 20% down-payment in advance of trying to get your loan, it is possible to qualify for a conventional loan.

Precisely what does an advance payment towards the an excellent FHA against Old-fashioned Loan Browse Instance?

Basically you are going to spend a great step three.5% advance payment on the an FHA financing. For those who have a reduced credit rating or loans so you’re able to earnings-ratio, that may increase so you’re able to 10%

Traditional loans want good 20% advance payment. If you don’t have 20% to get off, you have got to buy PMI ( Private mortgage insurance coverage) plus the superior you may indicate you get investing far more in the long term. Get a hold of our very own early in the day overview of PMI to learn more

Just what Ought i Understand My Credit score and you can Mortgage loans?

With an FHA Loan, your own FICO get can sometimes be from the lowest 500s, but lenders might require you to definitely build you to definitely upwards high very first just before they will accept your loan. you may have to consider some other things beyond your credit score alone, particularly commission history and you will loans-to-earnings proportion. If you have got a case of bankruptcy in the past, an FHA loan would-be simpler available than simply an excellent antique mortgage. The reduced your credit score, the greater this new asked advance payment might be.

With Conventional Financing, you desire the very least credit rating from 620, however, again, since pandemic, of many lenders need to push men and women conditions right up. Increased credit history will also help reduce your rates.

What about Home loan Insurance rates for the an enthusiastic FHA or Antique Mortgage?

FHA Money is insured of the Federal Property Authority and your up-side home loan premiums was step 1.75% of your own mortgage. The new FHA will get these types of premiums on the latest closing of your home, but you will obtain it placed into the general price of the home loan and you can shell out with it for the longevity of their loan. you will spend the money for FHA a yearly Private Financial superior that your particular lender will allow you to determine in line with the length of mortgage, the total amount you devote down, and the property value your residence.

Conventional loans render PMI ( Private Mortgage Insurance coverage) and afford the premium for at least sixty days into the a 30-seasons financial. If you have good fifteen-year home loan- after you’ve paid down approximately twenty two% of your own property value your loan, the loan payments can avoid.

Now that you have a summary and so are equipped with specific pointers to get the baseball going, the fresh new top loan providers at the EPM would love to support you in finding aside exactly what financing is the best for your individual needs. Our company is here to respond to your questions, and now have your already been on the road to homeownership with full confidence.